Ira contribution calculator fidelity

Get Up To 600 When Funding A New IRA. Click Calculate to view a chart that compares the after-tax benefits of contributing long-term appreciated.

Roth Conversion Calculator Fidelity Investments

EXAMPLE 2022 CONTRIBUTION YOURSELF STEP 1 Net Business Profits From Schedule C C-EZ or K-1 Amount 5 00.

. Invest With Schwab Today. Ad Explore Your Choices For Your IRA. Fidelity and its representatives.

Your Contribution Amount is. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. How much can I contribute to a SEP IRA.

Adjusted Earned Income Divide Step 4 by. Fidelity Roth Ira Contribution Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. The amount you will contribute to your Roth IRA each year.

You can pay live 25 of the final. With the reduction of many federal tax deductions charitable giving is one of the only levers you can easily adjust to surpass the standard deduction and increase your tax savings. Estimating assets at retirement requires calculating the number of 1 units of initial balances and the number of units of 1-per-year contributions.

The SEP IRA Calculating Your Contribution worksheet may be used by self-employed individuals to calculate their SEP IRA contribution. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Must be made by the employer and can vary.

SEP-IRA Calculator Results. Get Up To 600 When Funding A New IRA. To see the potential impact of such a contribution try using this calculator.

If you have a 500000 portfolio download 13 Retirement Investment Blunders to Avoid. This calculator is for educational use only illustrating how different user situations and decisions affect a hypothetical retirement income plan and should not be the basis for any investment or. This calculator assumes that you make your contribution at the beginning of each year.

Explore Choices For Your IRA Now. For comparison purposes Roth IRA. The first table is a table of projected future.

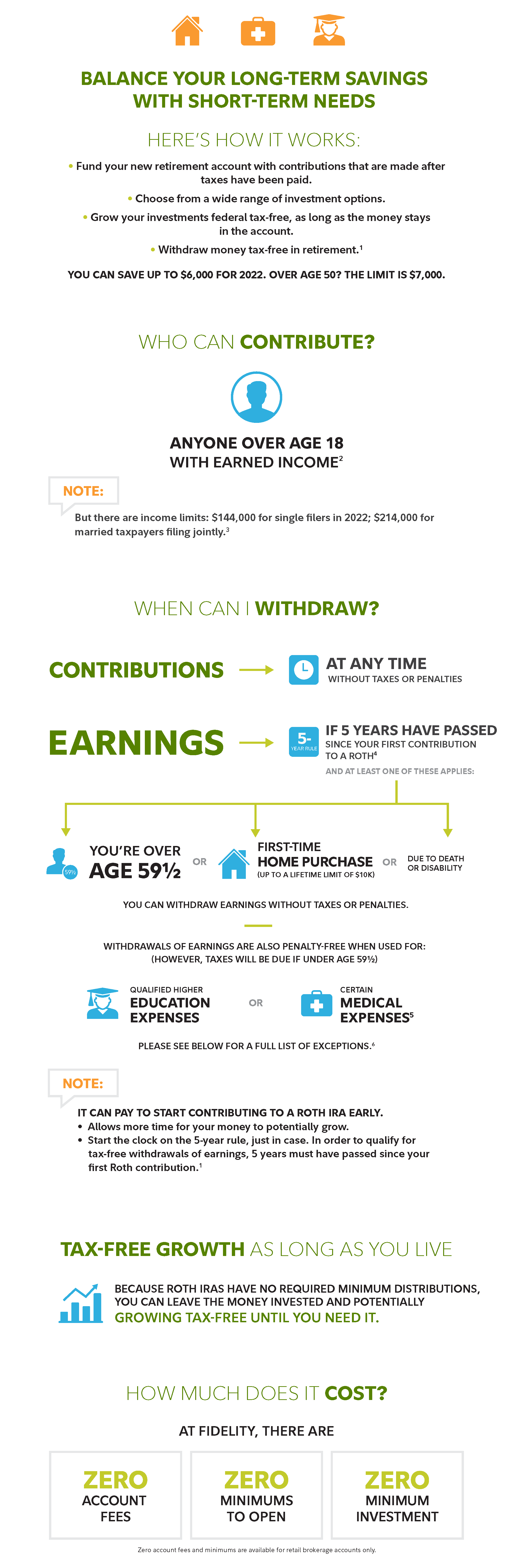

Ad Zero Minimums for Retail Brokerage Accounts Zero Account Fees from Fidelity. Contribution Factor Add 100 to Step 5 Step 7. Ad Download 13 Retirement Investment Blunders to Avoid from Fisher Investments.

You can calculate your scarf plan by donating charts and tables to Hoda Publication 560. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Get The Freedom To Plan For Your Income Needs And Legacy Goals.

STEP 2 Deductions for Self-Employment Tax From IRS. For 2021 full deductibility of a contribution is available to active participants whose 2021 Modified Adjusted Gross Income. Funded by employer contributions.

Ad Zero Minimums for Retail Brokerage Accounts Zero Account Fees from Fidelity. Earnings are tax-deferred and contributions are tax-deductible. When you make a pre-tax contribution to your.

Visit Investment Products Retirement click Self. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. You must be at least 18 years old to open an IRA with Fidelity.

What Is The Best Roth Ira Calculator District Capital Management

Financial Calculators Tools Fidelity

Contributing To Your Ira Start Early Know Your Limits Fidelity

Fidelity Go Review Smartasset Com

Mobile Finance Fidelity

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira

Roth Ira Conversion Calculator Is A Roth Ira Right For You Calculators By Calcxml Roth Ira Conversion Roth Ira Conversion Calculator

Save For The Future With A Roth Ira Fidelity

After Tax 401 K Contributions Retirement Benefits Fidelity

Fidelity Roth Ira Accounts For The Average Joe 2021 Youtube

They Include Social Security And Give A Score Out Of 100 Learn Just How Prepared For Retirement Yo Preparing For Retirement Fidelity Retirement Retirement

2

How To Protect Your Retirement Savings Fidelity Investments Investing Investment Portfolio Saving For Retirement

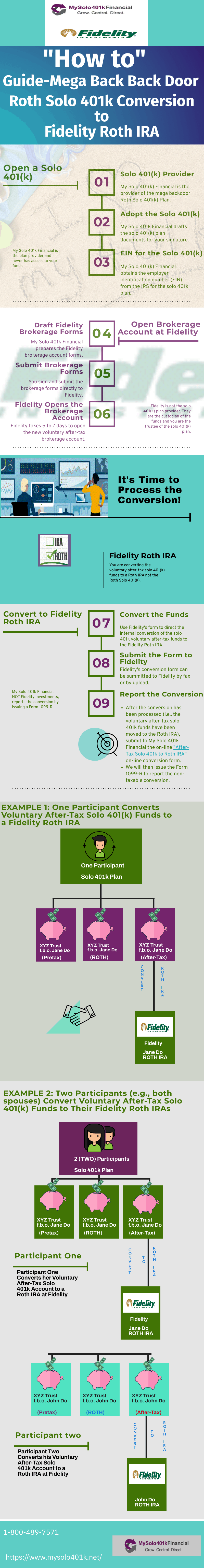

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

How To Invest Your Ira Fidelity Investing Investment Portfolio Saving For Retirement